| [version en cours de rédaction] | [version en cours de rédaction] |

(Page créée avec « {{Tuto Details |Main_Picture=Assigning_Commodity_Codes_download.jpg |Main_Picture_annotation={"version":"2.4.6","objects":[{"type":"image","version":"2.4.6","originX":"lef... ») |

|||

| Ligne 5 : | Ligne 5 : | ||

|Categories=Administration, Operation, Sales and Promotion | |Categories=Administration, Operation, Sales and Promotion | ||

}} | }} | ||

| − | <translate>'''The first step is to | + | <translate>'''The first step is to ask the Supplier of the part for the correct commodity code for a product, this is information they should be able to provide.''' |

If the supplier is unable to provide this information, or if this is a 'D' of 'H' manufactured to drawing part please follow the below. | If the supplier is unable to provide this information, or if this is a 'D' of 'H' manufactured to drawing part please follow the below. | ||

| Ligne 61 : | Ligne 61 : | ||

The Commodity code should then be saved n the correct field in the 'Product information' on Sage. </translate> | The Commodity code should then be saved n the correct field in the 'Product information' on Sage. </translate> | ||

{{PageLang | {{PageLang | ||

| + | |Language=en | ||

|SourceLanguage=none | |SourceLanguage=none | ||

|IsTranslation=0 | |IsTranslation=0 | ||

| − | |||

}} | }} | ||

{{AddComments}} | {{AddComments}} | ||

{{Tuto Status | {{Tuto Status | ||

| − | |Complete= | + | |Complete=Published |

}} | }} | ||

Version actuelle datée du 4 mars 2021 à 13:22

How to assign commodity codes to Products.

Sommaire

The first step is to ask the Supplier of the part for the correct commodity code for a product, this is information they should be able to provide.

If the supplier is unable to provide this information, or if this is a 'D' of 'H' manufactured to drawing part please follow the below.

You’ll need a commodity code to make your customs declaration when you bring goods in or send goods out of the UK. This includes goods sent to NI and Eire.

If you classify your goods correctly, you’ll know what rate of duty and import VAT you should pay,

Go to UK global online tariff at https://www.trade-tariff.service.gov.uk

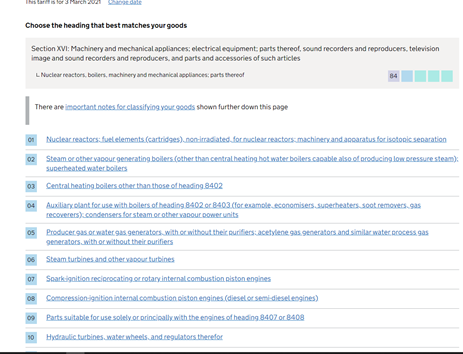

Choose the heading that best matches our goods.

Most of our parts are listed in the heading mechanical appliances -that is other than electrical components and PCs and consumables .

Then you would open the sub folder within those initial headings

So for cutters ---example

Tools –82

Knives and cutting blades for machines or mechanical appliances -08

Look down the sub folder, if the use is not listed, go other – 90

So the tariff code for cutters is 8208900000

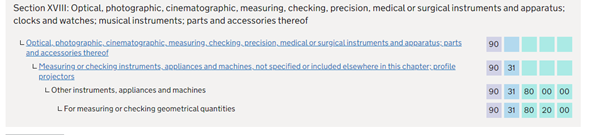

Another example is.

For our part E0000461

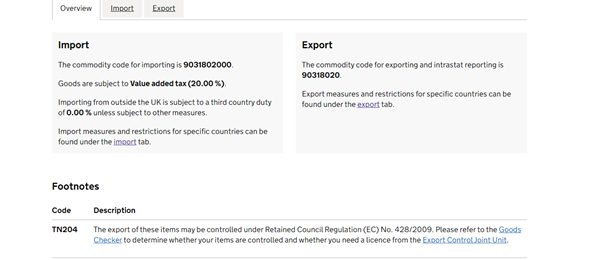

So tariff for our part E0000461 is 9031802000

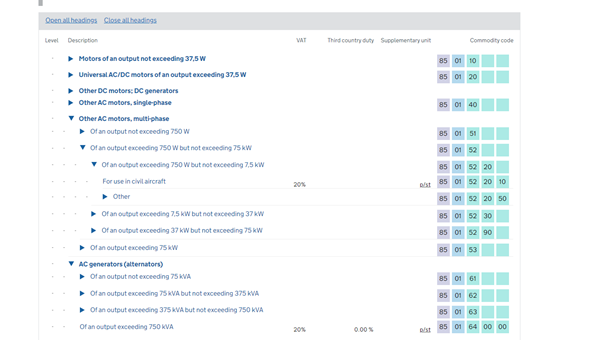

Motors are a little bit more complex.

Our part number C0001122

Therefore C0001122k – is 85015220

Footnote on page will advise you if this has any restrictions or duty payable.

The Commodity code should then be saved n the correct field in the 'Product information' on Sage.

Published

Français

Français English

English Deutsch

Deutsch Español

Español Italiano

Italiano Português

Português